#Open Banking API Management

Explore tagged Tumblr posts

Text

Empowering Consumers with API-Driven Banking: Enhancing Customer Experiences

The FinTech ecosystem is dynamic at its best, and in the high-octane banking landscape, API-powered innovations are emerging as a transformative force. The modern consumer has become more aware than ever, and APIs are revolutionizing how consumers manage their finances and interact with financial institutions. Read more info. please visit here - https://sites.google.com/view/api-driven-banking/

0 notes

Text

A really good illustration of average American historical awareness is that you frequently see people praising the Reagan era for savings account interest rates being so high. Despite the fact that inflation was significantly higher than those rates & also the cost of borrowing money was also much higher - the two reasons savings account rates ever go up. Which were a signature aspect of Reaganomics and also why you had so many high-profile business meltdowns towards the end of the 80s.

Yknow because the business model of a bank is that your savings account is a long term limited withdrawals deposit, they invest and loan from it, and then you only get a percentage of that action small enough to ensure their profits. So you only come out ahead on savings accounts relative to inflation if you manage to lock in a guaranteed rate at the peak offering and then inflation falls quickly and shortly after you opened it. The banks weren't offering 13% interest on savings accounts in 1981 out of the goodness of their hearts, it was because the bank could charge 19% apy on their mortgages and people had to suck that up and take it,all while overall inflation was up around 14% yearly and unemployment was skyrocketing.

9 notes

·

View notes

Text

What if I just become an annoying ADHD money blogger sometimes

#adhd adult money liveblogging

If you have problems saving money (especially emergency savings money) because you always spend it on too many impulse purchases, or take money out of your savings to cover your fun money:

you need to open a savings account with a new bank. The more impulsive you are, the more I recommend a small credit union or online only bank, or a really local bank. Someone whose online fund transfers to other banks takes three whole business days, so you literally can't just instant transfer money from savings to your checking account to spur of the moment buy things. If you're afraid this defeats the point of an emergency savings fund in the case of, well, an emergency, set up a small checking account with a minimal amount at this bank too, and just set aside the debit card somewhere you won't frequently use because it won't have much money until you pull it from emergency savings and put it in the checking account.

Look for one with a high APY relative to having basically no deposit minimum (mine is like 3%) and no minimum deposit or monthly fees. The APY is basically when bank sometimes pays you money for not spending money. It will be like, cents at first. Change in the sofa cushions. But over time, it will be more. Don't worry about it. It's just surprise money for later. Not a lot, mind you. But you're a competitive winner and every cent they give you FREE is a success to zap your brain with dopamine. (Eventually if you have enough money you can do this by like, investing in shit or buying CDs and they just give you MORE MONEY. BUT!!! BABY STEPS.)

This is crucial: if you have some kind of direct deposit paycheck set up, see if you can SPLIT the direct deposit between multiple accounts. The company my job uses to pay people allows us to choose between depositing a fixed dollar amount to certain accounts (with "remainder of paycheck balance" being automatic for one account), OR depositing a percentage of my paycheck to certain accounts. (Percents of a paycheck tend to be higher to start). If you don't get paid this way, figure out a good date to set a recurring transfer from your checking to your savings for an amount so it won't sit in your spendy account long. The goal is to pretend like you just actually never had the savings money in that paycheck. Poof. Gone. Disappeared. It got saved before you became aware of the money.

Feel free to start with a small amount. It can be $5 or whatever. Once you start doing this for a few paychecks look at your money. If you're not genuinely struggling to stay afloat after 2-3 months and are still comfortable, try increasing the number a little. Repeat as needed.

Now you've saved money. 🎉

This is genuinely how I managed to save money more consistently than anything else I've ever tried. Savings money goes in the secret money account. 🤷🏽♀️ Incredibly silly but it works.

36 notes

·

View notes

Text

What are the latest technological advancements shaping the future of fintech?

The financial technology (fintech) industry has witnessed an unprecedented wave of innovation over the past decade, reshaping how people and businesses manage money. As digital transformation accelerates, fintech new technologies are emerging, revolutionizing payments, lending, investments, and other financial services. These advancements, driven by fintech innovation, are not only enhancing user experience but also fostering greater financial inclusion and efficiency.

In this article, we will explore the most significant fintech trending technologies that are shaping the future of the industry. From blockchain to artificial intelligence, these innovations are redefining the boundaries of what fintech can achieve.

1. Blockchain and Cryptocurrencies

One of the most transformative advancements in fintech is the adoption of blockchain technology. Blockchain serves as the foundation for cryptocurrencies like Bitcoin, Ethereum, and stablecoins. Its decentralized, secure, and transparent nature has made it a game-changer in areas such as payments, remittances, and asset tokenization.

Key Impacts of Blockchain:

Decentralized Finance (DeFi): Blockchain is driving the rise of DeFi, which eliminates intermediaries like banks in financial transactions. DeFi platforms offer lending, borrowing, and trading services, accessible to anyone with an internet connection.

Cross-Border Payments: Blockchain simplifies and accelerates international transactions, reducing costs and increasing transparency.

Smart Contracts: These self-executing contracts are automating and securing financial agreements, streamlining operations across industries.

As blockchain adoption grows, businesses are exploring how to integrate this technology into their offerings to increase trust and efficiency.

2. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are at the core of fintech innovation, enabling smarter and more efficient financial services. These technologies are being used to analyze vast amounts of data, predict trends, and automate processes.

Applications of AI and ML:

Fraud Detection and Prevention: AI models detect anomalies and fraudulent transactions in real-time, enhancing security for both businesses and customers.

Personalized Financial Services: AI-driven chatbots and virtual assistants are offering tailored advice, improving customer engagement.

Credit Scoring: AI-powered algorithms provide more accurate and inclusive credit assessments, helping underserved populations gain access to loans.

AI and ML are enabling fintech companies to deliver faster, more reliable services while minimizing operational risks.

3. Open Banking

Open banking is one of the most significant fintech trending technologies, promoting collaboration between banks, fintechs, and third-party providers. It allows customers to share their financial data securely with authorized parties through APIs (Application Programming Interfaces).

Benefits of Open Banking:

Enhanced Financial Management: Aggregated data helps users better manage their finances across multiple accounts.

Increased Competition: Open banking fosters innovation, as fintech startups can create solutions tailored to specific customer needs.

Seamless Payments: Open banking APIs enable instant and direct payments, reducing reliance on traditional methods.

Open banking is paving the way for a more connected and customer-centric financial ecosystem.

4. Biometric Authentication

Security is paramount in the financial industry, and fintech innovation has led to the rise of biometric authentication. By using physical characteristics such as fingerprints, facial recognition, or voice patterns, biometric technologies enhance security while providing a seamless user experience.

Advantages of Biometric Authentication:

Improved Security: Biometrics significantly reduce the risk of fraud by making it difficult for unauthorized users to access accounts.

Faster Transactions: Users can authenticate themselves quickly, leading to smoother digital payment experiences.

Convenience: With no need to remember passwords, biometrics offer a more user-friendly approach to security.

As mobile banking and digital wallets gain popularity, biometric authentication is becoming a standard feature in fintech services.

5. Embedded Finance

Embedded finance involves integrating financial services into non-financial platforms, such as e-commerce websites or ride-hailing apps. This fintech new technology allows businesses to offer services like loans, insurance, or payment options directly within their applications.

Examples of Embedded Finance:

Buy Now, Pay Later (BNPL): E-commerce platforms enable customers to purchase products on credit, enhancing sales and customer satisfaction.

In-App Payments: Users can make seamless transactions without leaving the platform, improving convenience.

Insurance Integration: Platforms offer tailored insurance products at the point of sale.

Embedded finance is creating new revenue streams for businesses while simplifying the customer journey.

6. RegTech (Regulatory Technology)

As financial regulations evolve, fintech innovation is helping businesses stay compliant through RegTech solutions. These technologies automate compliance processes, reducing costs and minimizing errors.

Key Features of RegTech:

Automated Reporting: Streamlines regulatory reporting requirements, saving time and resources.

Risk Management: Identifies and mitigates potential risks through predictive analytics.

KYC and AML Compliance: Simplifies Know Your Customer (KYC) and Anti-Money Laundering (AML) processes.

RegTech ensures that fintech companies remain agile while adhering to complex regulatory frameworks.

7. Cloud Computing

Cloud computing has revolutionized the way fintech companies store and process data. By leveraging the cloud, businesses can scale rapidly and deliver services more efficiently.

Benefits of Cloud Computing:

Scalability: Enables businesses to handle large transaction volumes without investing in physical infrastructure.

Cost-Effectiveness: Reduces operational costs by eliminating the need for on-premise servers.

Data Security: Advanced cloud platforms offer robust security measures to protect sensitive financial data.

Cloud computing supports the rapid growth of fintech companies, ensuring reliability and flexibility.

The Role of Xettle Technologies in Fintech Innovation

Companies like Xettle Technologies are at the forefront of fintech new technologies, driving advancements that make financial services more accessible and efficient. With a focus on delivering cutting-edge solutions, Xettle Technologies helps businesses integrate the latest fintech trending technologies into their operations. From AI-powered analytics to secure cloud-based platforms, Xettle Technologies is empowering organizations to stay competitive in an ever-evolving industry.

Conclusion

The future of fintech is being shaped by transformative technologies that are redefining how financial services are delivered and consumed. From blockchain and AI to open banking and biometric authentication, these fintech new technologies are driving efficiency, security, and inclusivity. As companies like Xettle Technologies continue to innovate, the industry will unlock even greater opportunities for businesses and consumers alike. By embracing these fintech trending advancements, organizations can stay ahead of the curve and thrive in a dynamic financial landscape.

2 notes

·

View notes

Text

Everything You Need to Know About Venmo: A Detailed Guide

Venmo is a popular peer-to-peer payment service that simplifies the way we handle financial transactions. Whether you're adding funds, integrating with other payment systems, or understanding customer service options, this guide covers it all. Let’s dive into the details using some key topics and questions.

Send PayPal to Venmo

Currently, there isn't a direct way to send money from PayPal to Venmo. However, you can transfer funds between the two platforms through a linked bank account. Here’s how:

Transfer from PayPal to Bank: Move the desired amount from your PayPal balance to your linked bank account.

Transfer from Bank to Venmo: Once the funds are in your bank account, transfer them to your Venmo balance.

This method might take a few business days, but it's effective for moving money between PayPal and Venmo.

Venmo Add Funds

To add funds to your Venmo account:

Open the Venmo App: Log in to your account.

Navigate to Settings: Tap on the menu icon (☰) and select "Manage Balance."

Add Money: Tap "Add Money" and enter the amount you want to transfer.

Choose Bank Account: Select the linked bank account to transfer funds from.

Confirm: Review the details and confirm the transfer.

The funds will typically appear in your Venmo balance within 3-5 business days.

Venmo API

Venmo provides an API for developers to integrate Venmo payments into their applications. The API allows businesses to request and receive payments, handle refunds, and more. You can access the Venmo API documentation on the Venmo Developer site to get started with your integration.

Venmo Apple Pay

While Venmo and Apple Pay are separate services, you can use your Venmo card with Apple Pay. Here’s how:

Open Apple Wallet: On your iPhone, open the Wallet app.

Add Card: Tap the "+" sign to add a new card.

Enter Venmo Card Details: Either scan your Venmo card or manually enter the card information.

Verify: Follow the on-screen instructions to verify your card with Venmo.

Once added, you can use your Venmo card through Apple Pay for purchases wherever Apple Pay is accepted.

Venmo ATMs Near Me

To find ATMs that accept Venmo, follow these steps:

Use the Venmo App: Open the Venmo app and navigate to the "Venmo Card" section.

Find ATMs: Look for the "Find ATMs" option, which will help you locate ATMs nearby that accept Venmo.

Check Fees: Venmo offers free ATM withdrawals at certain ATMs (typically within the MoneyPass network). Out-of-network ATMs may charge a fee.

Venmo Call

If you need to contact Venmo customer service by phone, you can reach them at their venmo call official customer service telephone number. Visit the Venmo website or app for the venmo customer service telephone number most up-to-date contact information.

Venmo Chat

Venmo offers a chat feature for venmo chat customer support. To use Venmo chat:

Open the Venmo App: Log in and go to the menu (☰).

Select "Get Help": Tap on "Get Help" or "Contact Us."

Choose Chat Option: Select the chat option to start a conversation with a Venmo support representative.

Venmo Customer Service Telephone Number

For direct assistance, you can contact Venmo’s customer service via their official telephone number. Always refer to the Venmo website or app for the current number to ensure you reach the correct support line.

Venmo Email

To get in touch with Venmo via email, you can use their customer support email address. This can be found in the “Contact Us” section of venmo email the Venmo website or app. Email support is useful for detailed queries or issues that require documentation.

Venmo Free ATM

Venmo offers free ATM withdrawals at ATMs within the MoneyPass network. To venmo atms near me find a free ATM:

Use the Venmo App: Navigate to the "Venmo Card" section and use the "Find ATMs" feature.

MoneyPass Network: Look for ATMs that are part of the MoneyPass network to avoid withdrawal fees.

Venmo IRS

Venmo transactions may be subject to IRS reporting. If you receive $600 or more for goods and services, Venmo will issue a Form 1099-K for tax purposes. It’s important to report this income on your tax return. Consult a tax professional if you have questions about how Venmo transactions affect your taxes.

Venmo Limits Per Day

Venmo imposes certain limits on transactions:

Unverified Accounts: $299.99 per week.

Verified Accounts: Up to $4,999.99 per week for person-to-person payments and up to $6,999.99 per week for authorized merchant payments.

To increase your limits, you must verify your identity by providing personal information such as your Social Security number and date of birth.

Venmo Login for Android

To log in to Venmo on an Android device:

Download the Venmo App: Available on the Google Play Store.

Open the App: Tap the Venmo icon to open the app.

Enter Credentials: Enter your email or phone number and password.

Two-Factor Authentication: Complete any additional security steps, such as entering a verification code sent to your phone.

Once logged in, you can manage your Venmo account, send and receive payments, and more.

Conclusion

Venmo is a versatile payment platform that offers a range of features to manage your finances easily. Whether you’re adding funds, understanding limits, or contacting customer service, this guide provides all the information you need to use Venmo effectively. Stay informed and make the most out of your Venmo experience!

#venmo email#venmo chat#venmo atms near me#venmo customer service telephone number#send paypal to venmo#venmo free atm#venmo limits per day

5 notes

·

View notes

Text

SMS API Integration | Best SMS API Service In UAE & Saudi

SMS API in UAE: Streamlining Communication for Businesses

In today's digital landscape, effective communication is essential for businesses to thrive. One of the most powerful tools available to enhance communication is the SMS API in UAE. This technology allows companies to send messages directly to their customers’ mobile devices, making it an indispensable part of modern marketing and customer service strategies. In this blog, we will explore the significance of SMS API integration, the benefits of SMS API services, and how businesses in the UAE can leverage this technology to improve their operations.

What is an SMS API?

An SMS API (Application Programming Interface) is a set of protocols that allows software applications to send and receive SMS messages programmatically. This means businesses can automate their communication processes, sending out alerts, notifications, promotional messages, and more without needing to manually send each message. With the SMS API in UAE, companies can ensure they reach their audience quickly and efficiently.

Why SMS API Integration is Essential in the UAE

1. Direct Customer Engagement

In a rapidly digitizing world, consumers prefer immediate and accessible communication. SMS API integration in UAE enables businesses to engage with their customers directly through SMS. Whether it’s sending a confirmation for an online order or notifying customers about special offers, SMS provides a quick and reliable way to connect with audiences.

2. High Open Rates

SMS messages have remarkably high open rates, often exceeding 90%. This statistic is crucial for businesses aiming to ensure their messages are seen. When you utilize an SMS API in UAE, you can be confident that your communications are reaching your audience effectively, maximizing the impact of your marketing efforts.

3. Cost-Effective Marketing

Compared to traditional marketing channels, SMS marketing is significantly more cost-effective. By integrating an SMS API service in UAE, businesses can reduce their marketing expenses while still reaching a large audience. This is particularly beneficial for small and medium enterprises looking to grow without breaking the bank.

4. Automation of Communication

Automation is key to improving efficiency. With SMS API integration in UAE, businesses can set up automated workflows that trigger SMS messages based on specific actions. For example, if a customer makes a purchase, an automatic SMS can be sent to confirm their order. This not only saves time but also ensures that customers receive timely updates.

5. Enhanced Customer Experience

Providing excellent customer service is paramount for any business. With SMS, businesses can respond to inquiries, send reminders, and offer support quickly. The ability to integrate SMS into customer relationship management (CRM) systems through an SMS API allows for seamless communication, enhancing the overall customer experience.

How to Integrate SMS API in Your Business

Integrating an SMS API service in UAE involves several steps. Here’s a simple guide to get you started:

Step 1: Choose the Right SMS API Provider

The first step in SMS API integration in UAE is selecting a reliable SMS API provider. Consider factors like pricing, delivery rates, and customer support. Research various providers to find one that fits your business needs.

Step 2: Register for an Account

Once you’ve chosen a provider, you’ll need to register for an account. This usually involves providing some basic information about your business and agreeing to the terms of service.

Step 3: Obtain API Credentials

After registering, you will receive API credentials, including an API key and secret. These credentials are essential for authenticating your application when making requests to the SMS API.

Step 4: Set Up Your Application

With your API credentials in hand, you can begin integrating the SMS API into your application. Most providers offer comprehensive documentation to help you get started. You may need a developer or technical team to assist with this step.

Step 5: Test Your Integration

Before going live, it’s crucial to test your integration thoroughly. Send test messages to ensure that everything is functioning correctly. This step helps identify any issues that need to be addressed before you start using the service for real customer communications.

Step 6: Launch and Monitor

Once testing is complete, you can launch your SMS service. Keep an eye on the analytics provided by your SMS API service to monitor performance and make necessary adjustments to your strategy.

Use Cases for SMS API in the UAE

1. Marketing Campaigns

Businesses can utilize SMS API in UAE to send promotional messages, discounts, and updates about new products. This direct line of communication can significantly boost customer engagement and drive sales.

2. Appointment Reminders

For businesses in the healthcare or beauty industries, appointment reminders are crucial. An SMS API service in UAE can help automate reminders, reducing no-shows and ensuring clients are aware of their appointments.

3. Order Notifications

E-commerce businesses can use SMS APIs to keep customers informed about their orders. From confirmation messages to shipping notifications, SMS keeps customers in the loop, enhancing satisfaction.

4. Customer Support

SMS can also serve as a support channel, allowing customers to reach out with inquiries or concerns. With SMS API integration in UAE, businesses can respond quickly, improving overall customer service.

Conclusion

The digital age demands effective and efficient communication strategies, and SMS API in UAE offers a solution that meets these needs. With high open rates, cost-effectiveness, and the ability to automate communications, businesses can enhance their marketing efforts and improve customer experiences. By investing in SMS API integration, companies in the UAE can streamline their communication processes and stay ahead of the competition.

In summary, whether you’re a small startup or an established enterprise, integrating an SMS API service in UAE can provide significant benefits. Embrace this technology to transform the way you communicate with your customers and take your business to new heights.

0 notes

Text

Transparent Data Usage and Third-Party Integration Rules. A Roadmap for Fintech Leaders

Offering valuable services often involves using customer data and partnering with third-party platforms. While these integrations enhance functionality and competitiveness, they also bring significant responsibility. How data is handled, shared, and communicated can determine whether trust thrives or falters.

Why Data Transparency Matters Today.

Consumers have grown cautious about who holds their personal and financial information. High-profile breaches, misuse of data, and unauthorized sharing have made transparency essential — not optional.

Recent statistics reveal that:

A 2024 Trust in Tech survey shows 68% of consumers demand clarity on how their personal data is used.

Regulatory frameworks like GDPR in Europe, CPRA in California, and Brazil’s LGPD require precise disclosures and consent mechanisms.

In fintech, this is amplified by:

Sensitive data flows involving financial details, identity proof, and transaction history.

Integration with third-party providers — such as payment processors, KYC services, or analytics tools — that may introduce additional risks.

Establishing transparency means presenting privacy policies clearly, updating users on changes, and offering control over data usage and sharing.

A Framework for Responsible Third-Party Integrations.

Forging partnerships can boost product value, but each integration must be validated against multiple criteria. Key elements include:

1. Due Diligence and Vendor Assessment.

Before connecting APIs or embedding third-party services:

Investigate the third party’s data security controls and certification.

Evaluate their privacy standards, breach history, and audit outcomes.

Ensure contractual terms align with your compliance obligations.

Businesses that skip this stage may face audit failures or be held liable for partner missteps.

2. Clear Data Sharing Agreements.

Deals with third parties need to spell out:

What kinds of data are shared (transactional, identity, behavioral).

The specific use cases allowed.

Retention periods and deletion protocols.

Notification rules in the event of misuse or a breach.

These clauses form the structural foundation of transparent data governance and allow you to defend your practices to regulators and users.

3. Layered User Consent.

For customers to entrust sensitive data:

Provide granular opt-in choices rather than blanket consent.

Explain each data use clearly, including third-parties and analytics.

Enable users to revoke or update permissions at any time.

A positive experience here boosts loyalty and complies with evolving norms around consent management.

4. Audit Trails and Monitoring.

Maintaining visibility into data flows ensures ongoing compliance and adaptations:

Log every data transfer for traceability.

Periodically audit third-party controls to detect drift or vulnerabilities.

Share relevant portions of audit results with customers or regulators.

This level of reporting signals accountability and keeps stakeholders informed.

Regulatory Drivers and Industry Expectations.

Regulatory scrutiny of fintech data is expanding rapidly worldwide. In 2025, notable trends include:

Open Banking mandates in Europe and UK require API interfaces that clearly define third-party access and obligations.

Digital Operational Resilience Act (DORA) emphasizes operational risk, including vendor management and data governance.

Cross-border data flow restrictions in regions like the EU, China, and India require localization or certification of transfers.

Companies that stay updated and proactive in implementing these standards gain trust and avoid fines. Those that lag can face operational constraints and reputational setbacks.

Customer Communication: From Compliance to Confidence.

Transparency isn’t just a compliance checkbox — it’s a differentiator. Customers appreciate when a company explains:

What data is essential for service to function.

When data is shared, how, and with whom.

How their data benefits them and what controls they have.

Examples that build confidence include:

A clear dashboard showing permissions and third‑party partners.

Email updates when new partners are introduced.

Short videos or explainers walking users through consent settings.

Eric Hannelius, CEO of Pepper Pay, offers guidance on this dynamic: “When customers understand why data is collected and who is involved they’re more willing to share it. That understanding comes from open communication and accessible tools.”

Building a Transparent Tech Stack.

To operationalize transparency and integration rules, fintech firms must back their words with systems:

Consent Management Systems (CMS): Capture, track, and enforce permission across products and partners.

API Gateways and Data Access Controls: Ensure data requests from third parties are authenticated, logged, and restricted to agreed use cases.

Data Lineage Tools: Show how data moves within the system, who accesses it, and when it’s deleted.

Automated Compliance Reporting: Generate regular compliance reports to internal teams and external stakeholders.

These tools ensure that transparency and governance aren’t reliant on policy language alone — but are built into everyday operations.

Strategic Benefits of Transparency.

Embracing a transparent and responsible data strategy pays dividends:

Competitive advantage: Companies that earn trust through openness can attract customers who value privacy.

Flexibility in partnerships: Being known for responsible architecture makes integrations with banks and service providers smoother.

Regulatory readiness: Systems that enforce privacy rules and partner oversight limit risk during audits or structural reviews.

Talent attraction: Employees who care about ethics, privacy, and responsible innovation are more engaged in companies aligned with their values.

Final Thought: Leadership Beyond Compliance.

Transparent data usage and reliable third-party integration aren’t simply regulatory requirements — they are ethical standards, strategic differentiators, and customer commitments. In 2025, fintech firms will gain market advantage through openness, accountability, and thoughtful partnerships.

As Eric Hannelius states: “Transparency is the foundation of trust in fintech. If you can show users exactly how data moves — and give them control over it — you create loyalty that lasts. And in a field built on digital trust, that’s everything.” By aligning systems, communication, and leadership around responsible data practices, fintech organizations can deliver innovation without compromise.

0 notes

Text

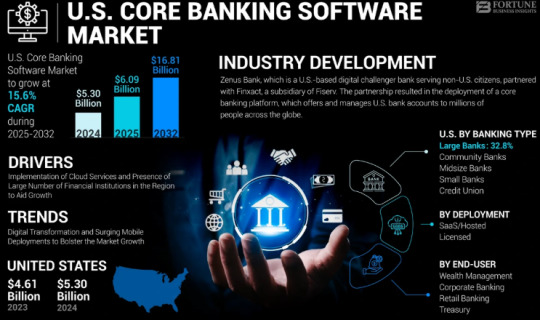

The U.S. Core Banking Software Market Size, Share | CAGR 15.6% during 2024-2030

The U.S. core banking software market Size was valued at USD 5.30 billion in 2024 and is projected to grow from USD 6.09 billion in 2025 to USD 16.81 billion by 2032, exhibiting a CAGR of 15.6% during the forecast period. Driven by the modernization of legacy banking systems, increasing customer demand for digital-first banking experiences, and adoption of cloud-native platforms, the U.S. banking industry is rapidly shifting toward agile, API-driven core banking systems.

Key Market Highlights:

2024 U.S. Market Size: USD 5.30 billion

2025 U.S. Market Size: USD 6.09 billion

2032 U.S. Market Size: USD 16.81 billion

CAGR (2025–2032): 15.6%

Market Outlook: Cloud-first transformation of retail and commercial banking infrastructure

Leading Players in the U.S. Market:

FIS (Fidelity National Information Services)

Finastra

Temenos USA

Oracle Financial Services Software

Jack Henry & Associates

SAP America

nCino

Infosys (EdgeVerve)

Thought Machine

Backbase

Mambu

Q2 Holdings

TCS BaNCS (U.S. operations)

Request Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/u-s-core-banking-software-market-107481

Market dynamics:

Growth Drivers:

Legacy System Modernization: Traditional banks are replacing decades-old core systems to enable agility, scalability, and faster innovation.

Rise of Digital-Only Banks & Neobanks: Challenger banks are opting for coreless and cloud-native platforms to deliver real-time banking experiences.

Regulatory Mandates: U.S. regulations increasingly demand transparency, real-time compliance, and modular tech stacks.

Omnichannel and Mobile Banking Boom: Surge in mobile-first customers is accelerating demand for flexible and API-driven core systems.

Adoption of BaaS & Embedded Finance: Banks are embedding financial services into non-banking platforms, requiring agile backend core systems.

Key Opportunities:

AI-Powered Core Modernization: Integration of AI for risk scoring, predictive analytics, and process automation

Cloud Migration Projects: Large-scale re-platforming from on-premise to cloud-native or hybrid models

Banking-as-a-Service (BaaS): U.S. institutions offering core services to fintechs and enterprises

Open Banking APIs: Ecosystem expansion through developer-friendly, regulatory-compliant APIs

Personalized Customer Experience Engines: Data-driven personalization built directly into core systems

Technology & Application Scope:

Deployment Models:

Cloud-native

On-premises

Hybrid (transitional)

Core Features:

Customer and account management

Payments and transaction processing

Lending and credit modules

Risk and compliance automation

Real-time reporting and dashboards

Target Users:

Retail banks

Credit unions

Community banks

Commercial and corporate banks

Neobanks and fintechs

Speak to Analysts: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/u-s-core-banking-software-market-107481

Recent Developments:

January 2024 – A top-10 U.S. bank announced a $700M multiyear plan to migrate its entire core system to a cloud-native microservices architecture with Temenos and AWS.

October 2023 – Jack Henry & Associates launched a new AI-powered fraud prevention module integrated into its core platform, reducing false positives by 45%.

July 2023 – A mid-sized credit union in the Midwest completed a legacy core banking system overhaul, leading to a 22% increase in customer satisfaction due to improved digital banking capabilities.

Trends Shaping the U.S. Core Banking Market:

Composable Banking Architecture: Shift toward modular, plug-and-play architecture

AI & Machine Learning in Core: Real-time fraud detection, dynamic credit risk models, and intelligent automation

Blockchain Integration: Experiments in real-time settlement, decentralized identity, and smart contracts

Low-Code/No-Code Customization: Democratization of development within banking teams

Cybersecurity Embedded in Core: Zero-trust frameworks and secure-by-design approaches

Conclusion:

The U.S. core banking software market is undergoing a significant transformation, driven by rising customer expectations, digital competition, and the imperative to stay compliant and resilient. The future belongs to banks that embrace modular, cloud-native, and API-driven core platforms—designed to scale, personalize, and evolve. As the market accelerates toward modernization, technology vendors and banks alike are finding immense value in flexible ecosystems, open banking capabilities, and real-time innovation.

Frequently Asked Questions: 1. What is the projected value of the global market by 2032?

2. What was the total market value in 2024?

3. What is the expected compound annual growth rate (CAGR) for the market during the forecast period of 2025 to 2032?

4. Which industry segment dominated market in 2023?

5. Who are the major companies?

6. Which region held the largest market share in 2023?

#U.S. Core Banking Software Market Share#U.S. Core Banking Software Market Size#U.S. Core Banking Software Market Industry#U.S. Core Banking Software Market Driver#U.S. Core Banking Software Market Growth#U.S. Core Banking Software Market Analysis#U.S. Core Banking Software Market Trends

0 notes

Text

Top Features to Expect from a P2P Crypto Exchange Development Company

In the rapidly evolving cryptocurrency landscape, P2P Exchange Development has emerged as a game-changer. Peer-to-peer platforms empower users to trade assets directly—without intermediaries—combining decentralization, security, and flexibility. If you're exploring P2P Cryptocurrency Exchange Development or shopping for P2P Cryptocurrency Exchange Software Solutions, it’s essential to know what makes a platform stand out. Here’s an in-depth guide to the top features any strong development partner should offer.

1. Robust Escrow & Smart Contract Integration

Why It Matters

Escrow ensures that neither party can deceive the other during a trade.

Smart contracts add automation and tamper-proof assurance, executing trades exactly as agreed.

What a P2P Exchange Development Firm Should Offer

Multi-signature wallets and escrow logic integrated at the blockchain or application layer.

Audit-ready smart contracts to prevent emission of faulty code.

Customizable escrow hold-release timelines—e.g., after user confirmation or predefined conditions.

These elements are foundational in P2P Cryptocurrency Exchange Development, mitigating fraud and earning user trust.

2. Multi-Currency & Multi-Payment Gateway Support

Why It’s Essential

Users expect flexibility to buy/sell various cryptocurrencies with diverse payment methods.

Developer Responsibilities

Support for BTC, ETH, stable coins (USDT, USDC), and even country-specific tokens.

Integration with payment systems (banks, UPI, mobile wallets, cash deposits).

Easy onboarding of new fiat currencies or payment options.

The right P2P Exchange Development team ensures your platform is accessible and inclusive.

3. User Reputation & Rating System

Why It’s Important

Trust is crucial. Reputation systems help users choose counterparties safely.

High-rating users attract more trades and enhance overall liquidity.

Implementation Strategy

Post-trade feedback system with star ratings and review comments.

Fraud or dispute flagging mechanisms.

Tiered visibility or fees—e.g., gold users get priority listings or lower fees.

These features are a key component of any reputable P2P Cryptocurrency Exchange Software Solutions.

4. Advanced Dispute Resolution Tools

Role in the Ecosystem

Even secure platforms face occasional disputes—over delivery, payments, or cancellations.

Must-Have Features

Built-in case management interface for admins and support agents.

User dialog interface to discuss and resolve issues.

Clear guidelines and timelines for dispute resolution—automatic resolution when users agree, manual review when needed.

Such mechanisms elevate P2P Cryptocurrency Exchange Development beyond simple trade matching.

5. KYC/AML Compliant & Optional ID Verification

Making Compliance Flexible

Orienting around global regulatory frameworks (e.g. FATF, EU-5AMLD).

Key Aspects

Optional or tiered KYC levels:

Tier 0: No verification (very low limits).

Tier 1: Basic verification (email/phone, low trading limits).

Tier 2: Full KYC (ID, proof of address) with large volume allowances.

Secure data handling: encryption, 2FA, data purging capabilities.

AML screening integrations (e.g., OFAC, global sanctions lists).

Providing compliance flexibility is a hallmark of serious P2P Exchange Development providers.

6. Intuitive UI/UX & Responsive Design

UX Drives User Retention

Many P2P platforms target emerging markets, where mobile usability is critical.

What to Look For

Clean dashboards showing open orders, trade history, and balance.

Quick order creation: choose crypto, fiat, price, quantity.

Payment method integration right in the trade flow.

Mobile-first (Android/iOS or responsive web) for on-the-go trading.

Great P2P Cryptocurrency Exchange Software Solutions always prioritize accessible, user-friendly UI/UX.

7. API Access & Bot Integration

Why It Matters

Power users and professional traders expect automation.

Implementation Needs

REST or Web Socket API for order creation, status, price feeds, and balance checking.

Rate limits and API key/token management.

Sample bot scripts and doc support.

These are features expected in P2P Cryptocurrency Exchange Development to cater to a broader user base.

8. Real-Time Analytics & Reporting

Operational Benefit

Admins need dashboards on trading volume, open orders, dispute stats, and revenue.

Functionality

Charts for daily/weekly/monthly performance.

P&L, fee breakdown, and token circulation tracking.

Automated report generation (CSV, PDF exports).

As trades increase, P2P Exchange Development must evolve with actionable insights.

9. Security & Scalability

Core Expectations

Security breaches can ruin reputation and trust.

Dedicated Measures

Encryption at rest and in transit, secure data centres, SSL certificates.

Hardened endpoints and anti-DDoS protection.

Optional cold/hot wallet architecture for fund storage.

Regular penetration testing and security audits.

Scalable architecture handles user spikes—vital in growing P2P Cryptocurrency Exchange Software Solutions.

10. Localization & Multi-Language Support

Global Reach Requires Localization

P2P platforms flourish with local languages and cultural adaptation.

Linguistic & Regional Adaptations

Translating UI, email templates, notifications.

Support for local date, time, number formats.

Culturally appropriate visuals and tone.

With proper localization, P2P Exchange Development becomes truly global.

11. Marketing Automation & User Engagement

Keeping Users Active

Retention is cheaper than acquisition—especially in peer-to-peer trading.

Smart Engagement Features

Built-in tools to launch referral programs, promotional offers, or rebates.

Push notifications, email/SMS alerts for trades, offers, price changes.

Targeted campaigns to re-engage dormant users.

Integrated engagement boosts the ROI of your P2P Cryptocurrency Exchange Development investment.

12. Plugin & Modular Architecture

Flexibility & Customization

Businesses want to differentiate their brand and processes.

Modular Components

Plug-and-play modules for KYC, wallet, escrow, dispute system.

Easier compliance customization and UI variations.

Faster development cycles using recomposable parts.

A hallmark of professional P2P Cryptocurrency Exchange Software Solutions.

13. Ongoing Maintenance & 24/7 Support

Development Doesn’t End at Launch

New threats, feature requests, and scaling issues emerge post-launch.

Provider Commitments

Clear SLAs for bug fixes and feature updates.

Dedicated 24/7 support (chat, phone, ticketing) for critical issues.

Infrastructure monitoring and uptime guarantees (e.g., 99.9%).

Comprehensive post-launch support completes any P2P Exchange Development package.

14. Regulatory Advisory & Legal Preparedness

Beyond Technical Build

A truly valuable partner understands global crypto regulation.

Advisory Services

Assistance in acquiring licenses (e.g., MAS, FinCEN, FATF guidelines).

Smart contract legal review.

Governing terms-of-service and user agreements.

Providing compliance counsel sets apart a top-tier P2P Crypto Exchange Development Company.

15. White-Label Option & Custom Branding

Time-to-Market & Brand Identity

White-label platforms are cost-effective and quick to deploy.

What It Includes

Custom UI branding: logos, colours, domain/subdomain.

No-code text/email template editing.

Admin control panel for granular platform settings.

An advanced feature in P2P Cryptocurrency Exchange Software Solutions for rapid brand adoption.

Final Thoughts

The P2P crypto exchange landscape is booming—driven by privacy, direct access, and decentralized control. If you're evaluating a P2P Cryptocurrency Exchange Development Company or considering P2P Exchange Development, prioritize these features:

Secure escrow and smart contracts

Multi-currency democracy and inclusive payment gateways

Reputation management and dispute mechanisms

Compliance tools (KYC/AML) tailored by user tiers

Engaging, mobile-optimized design

API support for automation

Insightful analytics dashboards

Strong security posture and scalable architecture

Localization and marketing modules

Modular design with ongoing support

Regulatory guidance and white-label deployment options

Together, these ensure your P2P platform is competitive, compliant, and user-trustworthy.

0 notes

Text

0 notes

Text

🏦✨ Neobanking: The Bank That Lives in Your Pocket

“No branches. No long queues. No lunch-hour panic. Just a smarter, sleeker way to bank — all from your phone.”

🌐 What Is a Neobank?

A neobank is a digital-only bank that operates entirely online — no physical locations, no paper forms, no waiting rooms.

It’s like if tech and finance had a stylish, hyper-efficient baby. Designed for today’s connected generation, neobanks combine the functionality of traditional banks with the agility of modern apps — all built for speed, convenience, and transparency.

💡 Why Neobanks Are Actually a Big Deal

Forget everything you think you know about banking. Neobanks are flipping the script — because you shouldn't need a suit, a signature, or a 9-to-5 appointment just to open an account or check your balance.

🔍 Here's why they matter:

Instant account opening in minutes, not days

Zero hidden fees — transparency is built-in

Real-time notifications to track every transaction

Smart budgeting tools to help you save better

Sleek UIs that don’t make you feel like you’re filing taxes

🚀 Who Are They For?

📱 The digital-first generation — people who expect banking to be as fast as texting 🌍 The global citizen — freelancers, creators, remote workers needing multi-currency accounts 📊 Small businesses & startups — who want better tools, faster onboarding, and 24/7 support 💡 The financially curious — those who value real-time insights over monthly statements

In short: Neobanks are for everyone who felt ignored by traditional banks.

🔮 Neobanking in 2025: What’s Coming

As we head deeper into the future, neobanks are evolving from simple app-based accounts into full-stack financial ecosystems.

💳 Cardless payments 🤖 AI-based savings recommendations 🔐 Biometric security 🏷️ Crypto integration and token rewards 🌐 Open banking APIs connecting your whole financial life

We're talking about banking that learns from you, adapts to your habits, and even grows with your goals.

🧠 “Your bank shouldn’t just hold your money. It should help you use it better.” — Neobanking logic, 2025 edition

🛠️ Neobanking + You = Financial Empowerment

You no longer need to fit into the old system. With neobanks, the system adapts to you.

🎯 Manage your budget 📈 Track your goals 🧾 Automate your savings 💬 Chat with AI or humans — instantly

🔐 And Yes — They’re Safe

Neobanks are regulated, secured, and designed with end-to-end encryption. Many partner with licensed banks or even hold their own banking licenses. It’s not only sleek — it’s smart and compliant.

Final Thought 💬

You don’t need a physical vault to trust your bank. You need clarity. Speed. Smart tools. And a little style. That’s what neobanking delivers — and it’s only just getting started.

📲Reblog if your banking fits in your pocket, not in a building

#Neobank#DigitalBanking#Fintech#FutureOfFinance#SmartMoney#FintechRevolution#StartupBanking#OpenBanking#FinancialInclusion#CryptoReady#MoneyMoves#TechForGood#FintechTumblr#BankingReimagined#AIinBanking#FintechVibes

0 notes

Text

How WhatsApp API Is Transforming the Finance Industry?

In the ever-evolving financial landscape, staying connected with customers in real time is critical. With rising expectations for instant communication, personalized service, and security, financial institutions are rapidly turning to WhatsApp Business API as a trusted channel. Offering convenience, scalability, and security, WhatsApp API is revolutionizing how banks, NBFCs, insurance providers, and fintech firms engage with their audience.

Here’s how WhatsApp API is helping the finance industry thrive:

Real-Time Transaction Alerts & Notifications Customers expect prompt updates about their financial activities. With WhatsApp API, banks and financial service providers can send:

Account balance updates

Debit/credit transaction alerts

Loan EMI reminders

Credit card payment alerts

Example: A customer receives a WhatsApp message instantly after a debit card transaction, helping them track expenses and spot suspicious activity in real-time.

Customer Support and Query Resolution WhatsApp offers a two-way communication channel. Customers can initiate conversations for account queries, loan details, or complaint resolutions. AI chatbots or live agents can manage queries 24/7, reducing call center loads and improving service speed.

Example: A fintech app integrates WhatsApp API to assist users with forgotten UPI PINs, KYC updates, and service requests directly within the chat interface.

Document Collection and Verification Collecting customer documents for loan processing, account opening, or KYC is often a bottleneck. With WhatsApp API, institutions can securely request and receive documents like Aadhaar, PAN, salary slips, etc., via chat.

Example: An NBFC sends a WhatsApp message requesting a customer to upload their latest bank statement for loan approval — all within the conversation thread.

Marketing and Lead Generation WhatsApp can be used (with opt-in consent) to share personalized offers, credit card deals, investment plans, insurance promotions, etc. It enhances conversion rates through interactive buttons and quick replies.

Example: A bank sends a customized message to pre-approved customers for a personal loan offer with “Apply Now” and “Talk to an Agent” buttons built into the chat.

Payment Reminders and Collections For finance companies, timely payments are vital. WhatsApp API allows for gentle, personalized reminders for EMI dues, insurance premium dates, or credit card bills — improving collection efficiency.

Example: An insurance company sends an automatic WhatsApp reminder with a payment link for monthly premiums, helping reduce churn.

Secure and Verified Communication WhatsApp API offers green tick verification and end-to-end encryption, making it a trusted channel for sensitive financial conversations. Customers are more likely to engage with messages from verified business accounts.

7. Loan Application Status and Onboarding WhatsApp API enables sending step-by-step loan status updates — from application received, under review, approved, disbursed — and even guides customers through onboarding and documentation.

Example: A customer who applied for a home loan receives WhatsApp updates at each stage — improving transparency and trust.

The WhatsApp Business API is no longer just a messaging tool — it’s a robust customer engagement platform that is driving real impact in the finance sector. Whether it’s delivering secure alerts, enabling two-way support, simplifying documentation, or automating marketing, WhatsApp empowers finance brands to provide timely, relevant, and humanized experiences.

At Dove Soft, we help financial institutions integrate WhatsApp API to drive smarter communication and better customer outcomes. Ready to revolutionize your customer experience? Let’s talk.

0 notes

Text

Own Your Fintech Fraud AI App in 30 Days: Fraud Detector MVP

Limited to 3 buyers at this price. Exclusivity option: Add $3,000. Page retires after 3 sales.

The Idea

Fintech Fraud Detector is a high-octane AI app that stops fraud dead in its tracks, protecting financial platforms from massive losses. Manual fraud checks are too slow — this MVP spots suspicious transactions in real-time, alerts teams, and syncs with payment systems. Perfect for fintech startups, it’s a golden ticket to dominate a high-demand market, ready to scale into a SaaS for banks, processors, or crypto platforms.

What You’ll Get

Real-Time Fraud Detection

Smart AI catches transaction anomalies instantly, saving millions.

Instant Alert System

Delivers clear, actionable alerts via web or mobile.

Web + Mobile App

Sleek interface for monitoring and managing fraud alerts.

Payment Platform Integration

Connects to Stripe via API for seamless transaction monitoring.

Bank-Grade Security

Encrypted data and secure access, meeting SOC2 standards.

Cloud Deployment Blueprint

Scalable AWS setup for high-volume transactions.

Future Roadmap Document

A plan to scale your MVP with predictive analytics and more.

What’s Excluded

Custom fraud models (available in full build).

On-premise hosting (cloud-only in pilot).

Advanced analytics dashboards (included in roadmap).

Ongoing support beyond handoff (optional add-on).

What You Need to Provide

Stripe API Access: Provide credentials or API key at project start for integration.

AWS Account: Your active AWS account for hosting (we’ll handle setup).

No other dependencies — our AI uses open-source tools for fraud detection.

Timeline

MVP Delivery: 30 Days

Planning + Setup: 3 days

AI Fraud Pipeline: 7 days

Frontend Interface: 8 days

Integration & Security: 8 days

Testing & Deployment: 4 days

Total: ~180 hours, 2–3 engineers

Price

$9,999

Exclusivity: Add $3,000 for sole ownership, or keep non-exclusive to save.

✔ Complete MVP with codebase, documentation, and future roadmap

✔ Full tech handoff or optional continued development

✔ 30-day delivery, under NDA

✔ No hidden costs

✔ Option to scale into a full product

After You Buy

Once you claim Fintech Fraud Detector:

Limited to 3 buyers; page retires after third sale or exclusivity purchase.

Our MVP team calls you within 12 hours to start.

Work begins on your timeline, as fast as same-day.

Why It’s Valuable

Market Gap: Fraud costs fintech billions — this MVP ensures trust and savings.

VC Magnet: Fintech is investor gold — pitch this for massive funding.

First-Mover Edge: Launch a market-leading solution in 30 days.

Revenue Potential: Sell to banks or crypto platforms as a SaaS.

Proven Speed: Built by our 150+ AI experts with 100+ projects and 98% client satisfaction.

Ready to Own Fintech Fraud Detector?

Ditch freelancers and slow agencies. Get a production-ready AI MVP in 30 days, built for fintech success. Book a free 30-minute strategy call to secure one of 3 slots or pitch your own idea. Act now — demand is sky-high!

Claim Your MVP | Get a Free Consultation

Pricing is an estimate. Final costs confirmed during your free consultation.

For More Updates: www.mvp.tech4bizsolutions.com

0 notes

Text

Selenium: The Cornerstone of Modern Web Automation Testing

In our increasingly digital world, websites are no longer just static information hubs. They are complex, interactive platforms powering essential services such as digital banking, e-learning, online shopping, and enterprise tools. As the role of web applications continues to expand, maintaining their reliability, efficiency, and intuitive design is more critical than ever. Whether managing a SaaS product or a dynamic e-commerce site, delivering a smooth user experience is inseparable from a robust and functional web interface.

Selenium: More Than Just a Single Tool

Selenium is often misunderstood as a standalone automation tool. In reality, it is a suite of specialized components, each addressing specific needs in browser-based automation. This flexibility allows teams to tailor their automation strategy according to their skill levels and project complexity.

The Selenium suite comprises:

Selenium IDE: A user-friendly browser extension for Chrome and Firefox that enables record-and-playback testing. It’s great for quick test creation, demos, or for those new to automation.

Selenium WebDriver: The core engine that offers direct interaction with web browsers through a rich API. It supports multiple languages and allows simulation of real-world user behavior with high precision.

Selenium Grid: Designed for distributed execution, it enables running tests in parallel across various browsers, operating systems, and machines, significantly reducing test duration and enhancing coverage.

This structure supports a progressive approach starting with simple test recordings and scaling up to advanced, enterprise-grade test frameworks. Enhance your web automation skills with our comprehensive Selenium Course Online, designed for beginners and professionals to master real-time testing techniques.

What Sets Selenium Apart in the Automation Landscape

Selenium remains a top choice among automation frameworks due to its open-source nature, adaptability, and strong community support. Its compatibility with several programming languages including Java, Python, JavaScript, and C# makes it highly versatile.

Notable strengths of Selenium include:

Cross-browser compatibility (Chrome, Firefox, Safari, Edge, etc.)

Cross-platform support for Windows, macOS, and Linux

Integration readiness with DevOps tools like Maven, Jenkins, Docker, and CI/CD pipelines

Large and active community, ensuring continuous enhancements and robust documentation

These features make Selenium an ideal solution for Agile and DevOps-driven environments where flexibility and scalability are essential.

Selenium WebDriver: The Automation Power Core

Selenium WebDriver is the most powerful and widely used component of the suite. It communicates directly with browsers using their native automation APIs, which leads to faster execution and more stable tests.

With WebDriver, testers can:

Simulate user actions such as clicking, typing, scrolling, and navigation

Interact with dynamic content and complex UI elements

Handle browser alerts, multiple tabs, and asynchronous behaviors

Use sophisticated waiting strategies to reduce flakiness

Its language flexibility and ease of integration with popular testing frameworks make it suitable for both functional and regression testing in modern applications.

Selenium Grid: For Fast, Parallel, and Scalable Testing

As projects grow in scale and complexity, running tests sequentially becomes impractical. Selenium Grid addresses this by supporting parallel test execution across different systems and environments.

Here’s how it works:

A central Hub routes test commands to multiple Nodes, each configured with specific browser and OS combinations.

Tests are automatically matched with suitable Nodes based on the desired configuration.

This setup enables:

Faster test cycles through concurrency

Expanded test coverage across platforms and browsers

Seamless scalability when integrated with Docker or cloud environments

Selenium Grid is particularly beneficial for CI/CD pipelines, enabling frequent and reliable testing in short time frames.

Challenges in Selenium and How to Overcome Them

Despite its many advantages, Selenium presents a few challenges. Fortunately, these can be addressed effectively with best practices and complementary tools.

1. Test Instability

Tests may fail unpredictably due to timing issues or dynamic content. Use robust locators, implement explicit or fluent waits, and add retry mechanisms where necessary.

2. High Maintenance Overhead

Frequent UI changes can break test scripts. Adopt the Page Object Model (POM), centralize selectors, and design modular, reusable components.

3. Lack of Native Reporting

Selenium does not include reporting features by default. Integrate reporting tools such as ExtentReports, Allure, or custom HTML reporters to visualize test outcomes and logs.

4. No Built-in Test Management

Selenium focuses on execution, not planning or tracking. Pair Selenium with test management tools like TestRail, Zephyr, or Jira plugins to organize and track testing efforts. Proactively addressing these issues leads to more reliable, maintainable, and scalable automation frameworks. Kickstart your career with our Best Training & Placement Program, offering expert-led sessions and guaranteed job support for a successful future in tech.

Selenium’s Strategic Role in Modern QA

As the software industry embraces continuous integration and delivery, quality assurance is shifting earlier in the development lifecycle, a practice known as Shift Left. Selenium supports this transition by enabling early and continuous automation.

Key benefits in modern workflows include:

Integration with CI tools like Jenkins, GitHub Actions, or Azure DevOps

Easy version control and code collaboration via Git

Support for data-driven testing, allowing validation of multiple scenarios using external data sources

This makes Selenium not just a testing tool, but a strategic partner in achieving high-quality, fast-paced software releases.

Conclusion

Selenium continues to play a crucial role in modern web automation. Its blend of flexibility, scalability, and open-source accessibility makes it a go-to framework for both startups and large enterprises. Whether you are verifying basic functionalities or managing a complex automation suite, Selenium equips you with the tools to build efficient and dependable tests. By following best practices such as structured test architecture, modular design, and integrated reporting Selenium can elevate your quality assurance efforts into a long-term strategic asset. As web technologies evolve and user expectations rise, Selenium will remain at the forefront of automated testing solutions.

0 notes

Text

SMS API in UAE: Streamlining Communication for Businesses

In today's digital landscape, effective communication is essential for businesses to thrive. One of the most powerful tools available to enhance communication is the SMS API in UAE. This technology allows companies to send messages directly to their customers’ mobile devices, making it an indispensable part of modern marketing and customer service strategies. In this blog, we will explore the significance of SMS API integration, the benefits of SMS API services, and how businesses in the UAE can leverage this technology to improve their operations.

What is an SMS API?

An SMS API (Application Programming Interface) is a set of protocols that allows software applications to send and receive SMS messages programmatically. This means businesses can automate their communication processes, sending out alerts, notifications, promotional messages, and more without needing to manually send each message. With the SMS API in UAE, companies can ensure they reach their audience quickly and efficiently.

Why SMS API Integration is Essential in the UAE

1. Direct Customer Engagement

In a rapidly digitizing world, consumers prefer immediate and accessible communication. SMS API integration in UAE enables businesses to engage with their customers directly through SMS. Whether it’s sending a confirmation for an online order or notifying customers about special offers, SMS provides a quick and reliable way to connect with audiences.

2. High Open Rates

SMS messages have remarkably high open rates, often exceeding 90%. This statistic is crucial for businesses aiming to ensure their messages are seen. When you utilize an SMS API in UAE, you can be confident that your communications are reaching your audience effectively, maximizing the impact of your marketing efforts.

3. Cost-Effective Marketing

Compared to traditional marketing channels, SMS marketing is significantly more cost-effective. By integrating an SMS API service in UAE, businesses can reduce their marketing expenses while still reaching a large audience. This is particularly beneficial for small and medium enterprises looking to grow without breaking the bank.

4. Automation of Communication

Automation is key to improving efficiency. With SMS API integration in UAE, businesses can set up automated workflows that trigger SMS messages based on specific actions. For example, if a customer makes a purchase, an automatic SMS can be sent to confirm their order. This not only saves time but also ensures that customers receive timely updates.

5. Enhanced Customer Experience

Providing excellent customer service is paramount for any business. With SMS, businesses can respond to inquiries, send reminders, and offer support quickly. The ability to integrate SMS into customer relationship management (CRM) systems through an SMS API allows for seamless communication, enhancing the overall customer experience.

How to Integrate SMS API in Your Business

Integrating an SMS API service in UAE involves several steps. Here’s a simple guide to get you started:

Step 1: Choose the Right SMS API Provider

The first step in SMS API integration in UAE is selecting a reliable SMS API provider. Consider factors like pricing, delivery rates, and customer support. Research various providers to find one that fits your business needs.

Step 2: Register for an Account

Once you’ve chosen a provider, you’ll need to register for an account. This usually involves providing some basic information about your business and agreeing to the terms of service.

Step 3: Obtain API Credentials

After registering, you will receive API credentials, including an API key and secret. These credentials are essential for authenticating your application when making requests to the SMS API.

Step 4: Set Up Your Application

With your API credentials in hand, you can begin integrating the SMS API into your application. Most providers offer comprehensive documentation to help you get started. You may need a developer or technical team to assist with this step.

Step 5: Test Your Integration

Before going live, it’s crucial to test your integration thoroughly. Send test messages to ensure that everything is functioning correctly. This step helps identify any issues that need to be addressed before you start using the service for real customer communications.

Step 6: Launch and Monitor

Once testing is complete, you can launch your SMS service. Keep an eye on the analytics provided by your SMS API service to monitor performance and make necessary adjustments to your strategy.

Use Cases for SMS API in the UAE

1. Marketing Campaigns

Businesses can utilize SMS API in UAE to send promotional messages, discounts, and updates about new products. This direct line of communication can significantly boost customer engagement and drive sales.

2. Appointment Reminders

For businesses in the healthcare or beauty industries, appointment reminders are crucial. An SMS API service in UAE can help automate reminders, reducing no-shows and ensuring clients are aware of their appointments.

3. Order Notifications

E-commerce businesses can use SMS APIs to keep customers informed about their orders. From confirmation messages to shipping notifications, SMS keeps customers in the loop, enhancing satisfaction.

4. Customer Support

SMS can also serve as a support channel, allowing customers to reach out with inquiries or concerns. With SMS API integration in UAE, businesses can respond quickly, improving overall customer service.

Conclusion

The digital age demands effective and efficient communication strategies, and SMS API in UAE offers a solution that meets these needs. With high open rates, cost-effectiveness, and the ability to automate communications, businesses can enhance their marketing efforts and improve customer experiences. By investing in SMS API integration, companies in the UAE can streamline their communication processes and stay ahead of the competition.

In summary, whether you’re a small startup or an established enterprise, integrating an SMS API service in UAE can provide significant benefits. Embrace this technology to transform the way you communicate with your customers and take your business to new heights.

0 notes